- 27/12/2025

- MyFinanceGyan

- 190 Views

- 4 Likes

- Finance

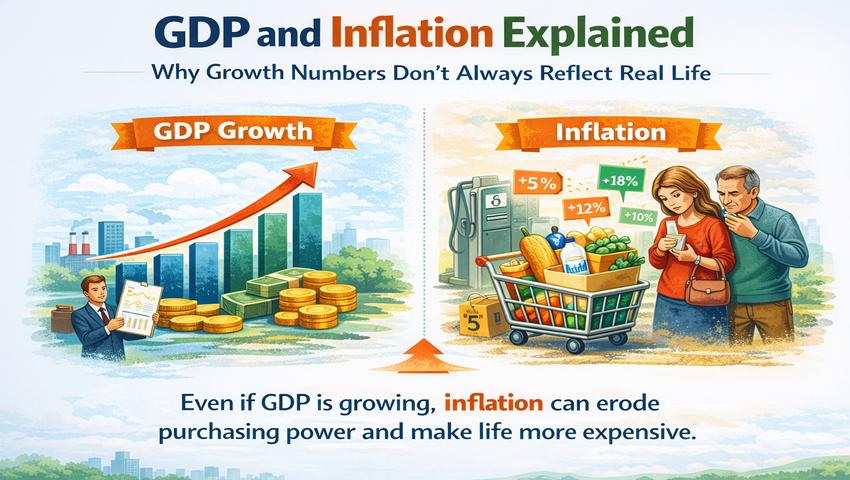

GDP and Inflation Explained: Why Growth Numbers Don’t Always Reflect Real Life?

We often hear headlines like “The economy grew by 6%” or “Inflation touched 8%.” These numbers sound impressive or worrying, but what do they really mean for our daily lives?

GDP growth and inflation are two of the most talked-about economic numbers. Yet, they can tell very different stories. An economy may look strong on paper, but people may still struggle with high prices and falling purchasing power.

This article explains GDP and inflation in simple terms, how they are connected, and why high growth does not always mean a better standard of living.

What Is GDP?

Gross Domestic Product (GDP) measures the total value of all goods and services produced in a country during a certain time period.

Think of GDP as the country’s economic report card. If production, spending, and investment increase, GDP goes up.

GDP can be calculated in three main ways:

- By adding what businesses produce

- By adding what people earn (wages, profits, rent)

- By adding what people and the government spend

In simple words:

If people buy more, companies produce more, and the government spends more, GDP increases.

But here’s the key point: GDP measures activity, not comfort or happiness.

Why GDP Growth Can Be Misleading?

A country’s GDP can grow even when most people feel worse off.

Examples:

- If more luxury cars or expensive machinery are produced, GDP rises—but this doesn’t help families struggling with food or rent.

- After floods or earthquakes, rebuilding increases GDP, even though people are just replacing what they lost.

GDP also comes in two forms:

- Nominal GDP – not adjusted for inflation

- Real GDP – adjusted for rising prices

Real GDP is better, but even that doesn’t show whether income growth is reaching ordinary people.

What Is Inflation?

Inflation means a general rise in prices over time. When inflation increases, your money buys less.

For example:

If inflation is 5%, something that cost ₹100 last year now costs ₹105.

Some inflation is normal and even healthy. Most central banks aim for moderate inflation (around 2–4%) to support spending and growth.

But high inflation hurts households, especially when salaries don’t rise at the same speed.

Types of Inflation:

- Demand-driven: Too many buyers, too few goods

- Cost-driven: Higher fuel, wages, or raw material costs

- Expectation-driven: People expect inflation, so prices and wages rise further

How GDP and Inflation Are Connected?

GDP and inflation influence each other constantly.

- Fast GDP growth can increase demand and push prices up.

- High inflation reduces purchasing power, which can slow growth.

Here’s how different situations look:

A healthy economy tries to balance steady growth with stable prices.

When Growth Hides the Pain of Inflation?

Imagine this situation:

- GDP growth: 8%

- Inflation: 9%

In real terms, people are actually worse off.

This is why strong GDP headlines don’t always feel good in real life. What matters is real income—income after adjusting for inflation.

Example:

- Salary rises from ₹50,000 to ₹53,000 (6% increase)

- Inflation is 8%

Result: Your purchasing power falls, even though your salary increased.

Nominal vs Real GDP: Why the Difference Matters?

During high inflation:

- Nominal GDP may rise sharply

- But real production may stay flat

If GDP rises 20% but inflation is also 20%, there is no real growth—everything just became more expensive.

That’s why economists focus on real GDP, not headline numbers.

Measuring the Real Cost of Living:

Inflation is commonly measured using the Consumer Price Index (CPI), which tracks prices of daily essentials like food, housing, transport, and healthcare.

But CPI is an average:

- It doesn’t reflect regional differences

- Poorer households feel inflation more because they spend more on essentials

Other measures like core inflation or PCE offer additional insights, but none fully capture how inflation feels in daily life.

Why Policymakers Face a Tough Choice?

Central banks control inflation mainly through interest rates:

- High inflation → raise rates → reduce spending

- Slow growth → cut rates → encourage borrowing

But this balance is tricky:

- High rates can slow growth and increase unemployment

- Low rates can worsen inflation

Governments also use taxes and spending to influence the economy, but coordination is often imperfect.

How Inflation Affects Households?

Behind economic data are real people. Inflation impacts daily life in many ways:

- Savings lose value

- Loans and EMIs become costlier

- Inequality increases

- Financial stress rises

People with assets like property or stocks may benefit, while those relying on salaries suffer the most.

Why Productivity Matters?

The best way to grow without inflation is by improving productivity—producing more with the same resources.

When productivity rises:

- Wages can increase

- Prices stay stable

Education, technology, and infrastructure play a big role here.

Lessons From History:

- India: Strong growth with periodic inflation spikes, often hurting rural and low-income households

- USA (1970s): High inflation and unemployment showed how inflation can destroy real wealth

- Post-COVID: GDP bounced back globally, but inflation erased many gains

Looking Beyond GDP:

Economists now agree GDP alone isn’t enough. Other measures matter:

- Human Development Index (HDI)

- Well-being and happiness indicators

- Environmental and inequality-adjusted measures

Growth without stability and fairness is incomplete.

What Individuals Can Do?

People can protect themselves by:

- Investing in assets that beat inflation

- Increasing skills and income sources

- Tracking real income, not just salary hikes

- Managing budgets carefully

- Staying informed about economic changes

Financial awareness helps soften inflation’s impact.

Final Thoughts: Look Beyond the Headlines:

GDP numbers may look impressive, but they don’t tell the full story. True progress depends on:

- Stable prices

- Fair income growth

- Better quality of life

High inflation can quietly cancel out economic growth, making prosperity an illusion for many.

So next time you hear about record GDP growth, ask:

- Are prices under control?

- Are incomes really rising?

- Are people better off?

Understanding GDP and inflation helps us see the economy as it truly is—not just as numbers, but as lived reality.

Disclaimer:

The views expressed in this article are personal and intended only for awareness and educational purposes. This content does not provide any product or investment recommendations.