- 22/12/2025

- MyFinanceGyan

- 251 Views

- 3 Likes

- Finance

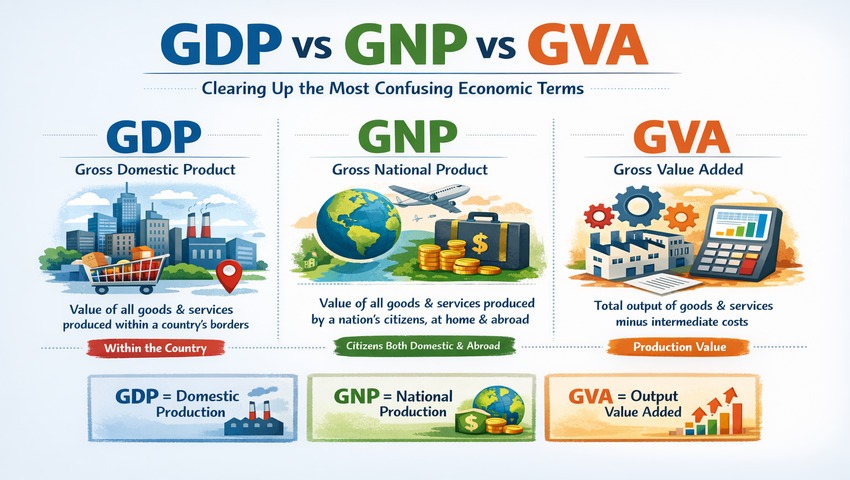

GDP vs GNP vs GVA: Clearing Up the Most Confusing Economic Terms

Gross Domestic Product (GDP), Gross National Product (GNP), and Gross Value Added (GVA) are three of the most important indicators used to measure a country’s economic performance. Although these terms are often used interchangeably, each highlights a different aspect of economic activity.

Understanding the distinction between them helps investors, policymakers, business owners, and citizens interpret economic data more accurately and make informed decisions.

What Is GDP? Understanding the Economy's Overall Size:

Gross Domestic Product (GDP) measures the total value of all final goods and services produced within a country’s geographical boundaries during a specific period, usually a year or a quarter. It focuses purely on domestic production, regardless of who owns the resources or businesses.

GDP can be calculated using three approaches:

- Expenditure method: Consumption + Investment + Government spending + Net exports (C + I + G + X – M)

- Income method

- Production method

Because of its territorial nature, GDP is widely used for international comparisons. For example, if a foreign-owned factory operates in India, its output is counted in India’s GDP. Strong GDP growth often indicates rising employment, increased consumption, and higher business confidence, influencing central bank policies such as interest rate decisions.

What Is GNP? Measuring Citizens' Global Income:

Gross National Product (GNP) measures the total value of goods and services produced by a country’s residents, whether the production takes place domestically or abroad.

In simple terms:

GNP = GDP + Net income from abroad

Net income from abroad includes income earned by citizens working overseas minus income earned by foreign entities operating domestically.

GNP is particularly useful for understanding national income and welfare, especially in countries with large migrant populations or overseas investments. For instance:

- India’s GNP is generally lower than its GDP due to profits repatriated by foreign companies.

- Countries like the Philippines often show higher GNP due to remittances from overseas workers.

GNP per capita can sometimes provide a better picture of living standards than GDP per capita.

What Is GVA? Measuring Sector-Wise Value Creation:

Gross Value Added (GVA) measures the value generated by different sectors of the economy by subtracting intermediate consumption from total output. This avoids double counting and reflects the actual value created by producers.

At the macro level:

GDP = GVA (at basic prices) + Taxes on products – Subsidies on products

GVA is a supply-side measure and is extremely useful for understanding which sectors—such as agriculture, manufacturing, or services—are driving or slowing economic growth.

India began emphasizing GVA after 2015 to gain clearer insights into sectoral performance and design more targeted economic policies.

Key Differences Between GDP, GNP, and GVA:

GDP and GNP differ mainly due to net factor income from abroad, while GVA serves as the building block of GDP by offering granular insights.

Real-World Examples: India and Global Economies

In India, GDP figures are often higher than GNP due to foreign companies repatriating profits. Variations between GDP and GVA growth rates can reveal sector-specific issues—for example, strong services growth masking manufacturing weakness.

Globally:

- The United States relies primarily on GDP to measure domestic economic strength.

- Ireland uses GNP to adjust GDP figures inflated by multinational corporations.

- The European Union uses GVA extensively to assess industry-wise recovery and productivity.

Why These Metrics Matter?

- Investors track GDP for growth potential, GNP for income sustainability, and GVA for sectoral opportunities.

- Policymakers use GVA to allocate budgets, design incentives, and support lagging sectors.

- Businesses rely on GVA trends to identify high-growth industries.

- Citizens can better understand employment prospects, inflation trends, and income growth.

Per capita versions of these indicators provide additional clarity on living standards.

Common Misconceptions Explained:

- GDP is not national wealth; it measures annual economic activity, not accumulated assets.

- Higher GDP does not always mean higher prosperity, especially when income inequality is high.

- GVA is not pre-tax GDP, but a pure measure of value creation at the production level.

A balanced analysis requires using all three indicators together.

Which Metric Should You Use?

- Use GDP to assess overall economic growth

- Use GNP per capita to evaluate income and welfare

- Use GVA for sector-level analysis and policy insights

Together, they provide a complete picture of economic health.

The Future of Economic Measurement:

As economies evolve, traditional indicators are being supplemented with new measures that account for digital services, sustainability, and environmental impact. Concepts such as green GDP and sustainability-adjusted national income are gaining relevance.

Despite these changes, GDP, GNP, and GVA remain foundational tools for understanding economic performance.

Disclaimer:

The views expressed in this article are personal and solely for educational and awareness purposes. This content is not intended to provide financial, investment, or product-related recommendations.