- 06/02/2026

- MyFinanceGyan

- 14 Views

- 0 Likes

- GST

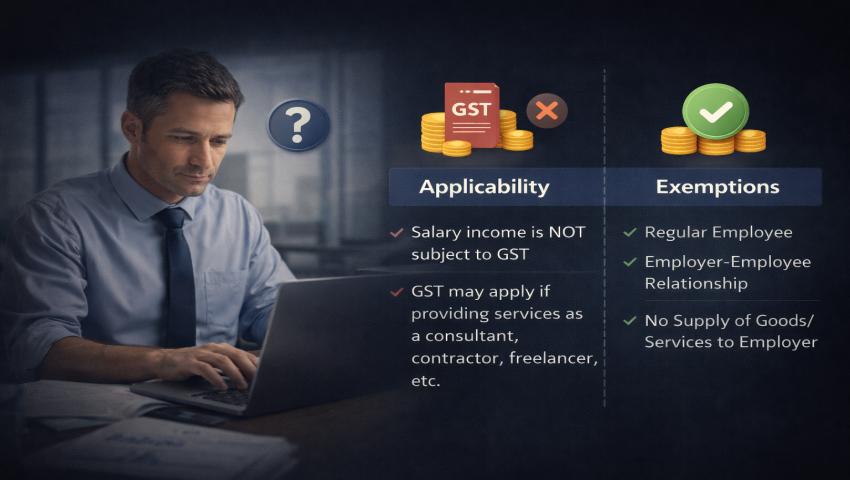

GST on Salary – Applicability and Exemptions

The question of whether GST applies to salary is one of the most common areas of confusion for employers, HR teams, and employees. Since GST covers a wide range of services, many assume that payments made by companies to employees may also attract GST.

In reality, GST law makes a clear distinction between employment-related payments and taxable services. Understanding this distinction is crucial to ensure correct GST compliance and to avoid unnecessary tax disputes or incorrect tax payments.

This blog explains when GST is not applicable on salary, the key exemptions, and the special cases where GST may still apply.

Understanding GST in the Context of Salary:

GST is applicable on the supply of goods or services for a consideration in the course or furtherance of business. To determine whether GST applies to salary, the nature of the relationship between the payer and the recipient must be examined.

Under GST law, services provided by an employee to an employer in the course of employment are treated differently from services provided by an independent professional or consultant.

Is GST Applicable on Salary?

No. GST is not applicable on salary paid to employees.

As per Schedule III of the CGST Act, services provided by an employee to the employer in the course of or in relation to employment are neither considered a supply of goods nor a supply of services. Since GST is levied only on supplies, salary payments fall completely outside the scope of GST.

This exclusion is the fundamental reason why GST does not apply to salary.

Why Salary Is Exempt from GST?

Salary is exempt from GST because…

- It is paid under a formal employment contract

- The employer–employee relationship is not a commercial service arrangement

- Salary is compensation for employment, not consideration for a taxable supply

As long as a genuine employer–employee relationship exists, GST is not applicable.

Payments Covered Under Salary Exemption:

The following payments are generally treated as part of salary and do not attract GST:

- Basic salary

- Dearness allowance

- House Rent Allowance (HRA)

- Conveyance or transport allowance

- Bonus and performance incentives

- Leave encashment

- Employer's contribution to PF and ESI

- Gratuity and retirement benefits

These payments remain outside GST as long as they arise from the employment relationship.

GST on Director's Remuneration – A Special Case:

The applicability of GST on director’s payments depends on the nature of the director’s role.

Executive or Whole-Time Directors

If a director is employed under an employment contract and receives salary:

- GST is not applicable

- The payment is treated as salary

- Employer–employee relationship exists

Non-Executive or Independent Directors

Payments made to non-executive or independent directors are not treated as salary. In such cases:

- GST is applicable

- Tax is payable under the Reverse Charge Mechanism (RCM)

- The company is responsible for paying GST

This distinction is critical for GST compliance.

GST on Employee Reimbursements:

Employee reimbursements often create GST-related confusion.

1. Reimbursements Not Subject to GST:

GST is generally not applicable if reimbursements:

- Are made on an actual cost basis

- Are supported by valid bills or vouchers

- Form part of employment terms

Such reimbursements are treated as part of salary.

2. Reimbursements That May Attract GST:

GST may apply if reimbursements are:

- Fixed or lump-sum in nature

- Not linked to actual expenses

- Provided as a benefit rather than reimbursement

The taxability depends on the structure and documentation.

GST on Notice Pay Recovery:

When an employee leaves without serving the required notice period, employers may recover notice pay. Tax authorities sometimes view this as consideration for tolerating an act, which can attract GST.

Several advance rulings have indicated that GST may be applicable on notice pay recovery. Since interpretations vary, businesses should evaluate this carefully and seek professional advice.

GST on Employee Benefits and Perquisites:

Certain employee benefits may attract GST if they are not part of contractual employment obligations.

Benefits Generally Not Taxable:

- Canteen facilities (subject to conditions)

- Medical benefits as per company policy

- Job-related training and skill development

Benefits That May Attract GST:

- Free accommodation for personal use

- Gifts exceeding prescribed limits

- Services provided for non-business purposes

GST applicability depends on whether such benefits qualify as a taxable supply.

Input Tax Credit (ITC) on Employee-Related Expenses:

Businesses often question whether GST paid on employee-related expenses is eligible for input tax credit.

Under GST law:

- ITC is blocked on certain employee benefits such as food, health insurance, and personal services

- ITC may be allowed if providing such benefits is mandatory under any law

Careful evaluation is necessary to avoid ITC reversals and penalties.

Compliance Perspective for Employers:

To ensure smooth compliance, employers should:

- Maintain clear employment contracts

- Properly classify payments as salary or professional fees

- Apply correct GST treatment to director remuneration

- Maintain documentation for reimbursements and recoveries

Strong documentation helps defend GST positions during audits and assessments.

Common Misconceptions About GST on Salary:

- Assuming GST applies to all payments made by companies

- Treating salary as a taxable service

- Charging GST on reimbursements unnecessarily

- Confusing professional fees with salary payments

Clarity on GST provisions helps prevent these errors.

Conclusion:

GST is not applicable on salary paid to employees, as services rendered under an employer–employee relationship are specifically excluded from GST. However, certain payments such as director fees, notice pay recovery, and specific employee benefits may attract GST depending on their nature.

Understanding the applicability and exemptions of GST on salary is essential for employers and employees to ensure correct compliance, avoid disputes, and manage GST risks effectively.

Disclaimer: This article is for general informational purposes only and does not constitute legal, tax, or professional advice; readers are advised to consult a qualified tax professional for guidance specific to their situation.