Export of Services under GST – Meaning, Conditions & Simple Examples

Under India's GST system, exports are treated as a key contributor to economic growth and foreign exchange earnings. To promote international trade, the law grants zero-rated status to exports—including the export of services under GST.

GST Cancellation Procedure Step-by-Step Guide, Rules & Key Considerations

GST registration is mandatory for many businesses in India, but it is not always permanent. If a business closes, restructures, transfers ownership, or no longer meets the registration threshold, cancellation of GST registration becomes necessary.

About GST – How to get a GST number?

A gst number is a 15-digit alphanumeric code assigned to every registered business. Think of it as your business's unique identity card for all tax-related matters.

GST on Gold: What You Need to Know?

Before GST was introduced in 2017, gold was subject to a variety of taxes like Value Added Tax (VAT) and Excise Duty, which varied from state to state.

GST Refund Time Limit – Complete Process Explained

This article explains the GST refund time limit and the complete refund process in a simple and structured manner, helping taxpayers claim refunds efficiently and avoid rejection due to non-compliance.

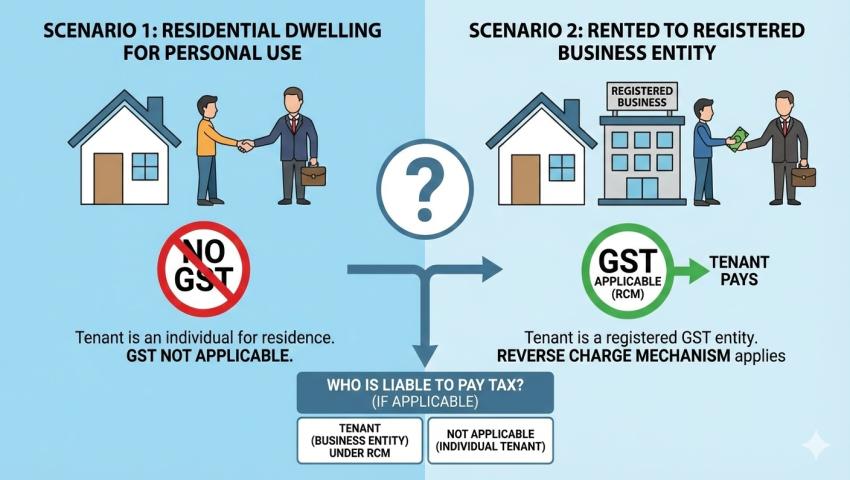

GST on Residential Property Rent – Who Is Liable to Pay Tax?

The applicability of GST on residential property rent has been a subject of confusion, especially after key amendments under the GST regime. Landlords, tenants, and businesses often struggle to determine whether GST is applicable, who is liable to pay it, and when exemptions apply.

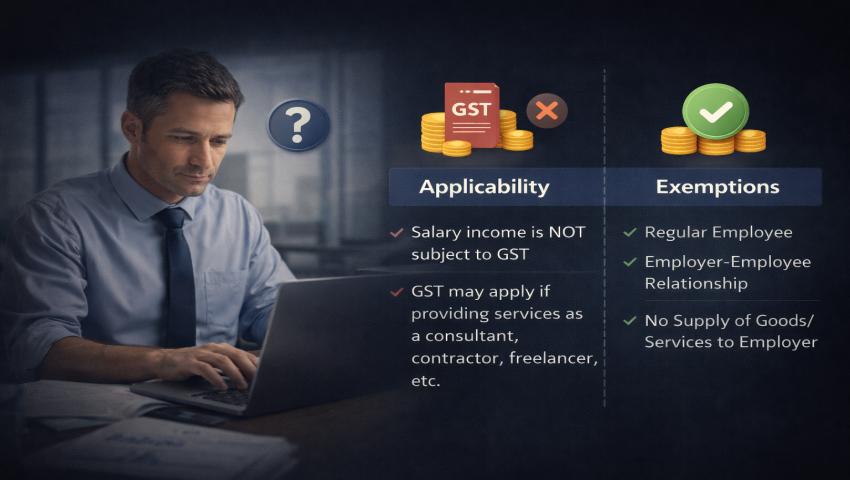

GST on Salary – Applicability and Exemptions

The question of whether GST applies to salary is one of the most common areas of confusion for employers, HR teams, and employees.

Models of GST – Types Explained Simply

The introduction of Goods and Services Tax (GST) marked one of the most significant reforms in India's indirect tax system. By replacing multiple indirect taxes with a unified framework, GST brought transparency and consistency across the country.

What Is GST Tax Exemption? Meaning, Rules, and Eligibility Explained

Navigating the complex landscape of the Goods and Services Tax (GST) in India can be a daunting task for entrepreneurs and small business owners. However, understanding goods and services tax exemptions is a game-changer for your financial planning.

0% GST on Health and Life Insurance: What It Means for You in 2025

The Government of India's decision to introduce 0% GST on health and life insurance premiums has created a major buzz among policyholders and new buyers.