Comparison Guide: 44AD vs 44ADA vs Regular Tax – Which Tax Regime Should You Choose?

This practical guide explains the difference between 44AD vs 44ADA vs Regular Tax, helping you understand eligibility, income calculation, compliance requirements, and when each option may be suitable.

What Is Commercial Tax? Meaning, Types & Examples

In simple words, Commercial Tax is a tax imposed by the State Government on commercial activities. It is an indirect tax, meaning the business pays it to the government, but the cost is ultimately recovered from the customer.

How to Do Online Income Tax Return (ITR) Filing in India?

An Income Tax Return (ITR) is a form used to declare your annual income, tax-saving deductions, and taxes paid to the Income Tax Department. Filing ITR is a sign of financial discipline and is mandatory for those whose income exceeds the basic exemption limit.

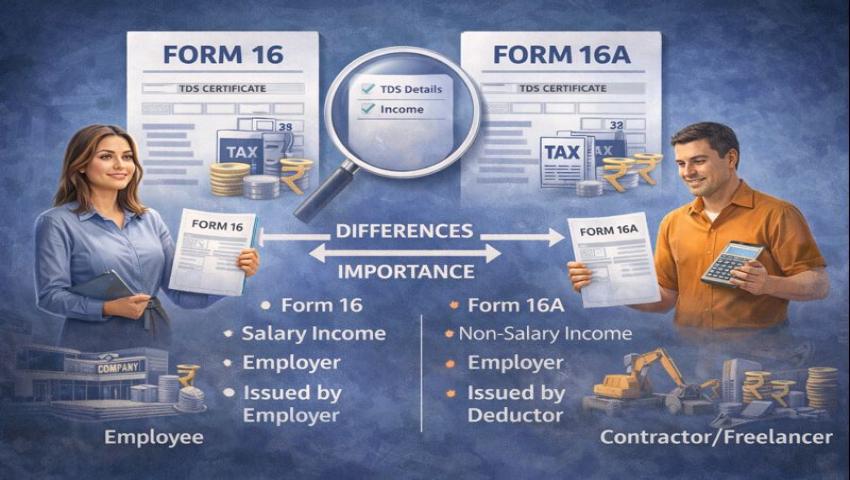

Form 16 and Form 16A – Meaning, Difference and Importance

When it comes to income tax compliance in India, documents related to Tax Deducted at Source (TDS) play a critical role. Among these, Form 16 and Form 16A are the most commonly used TDS certificates.

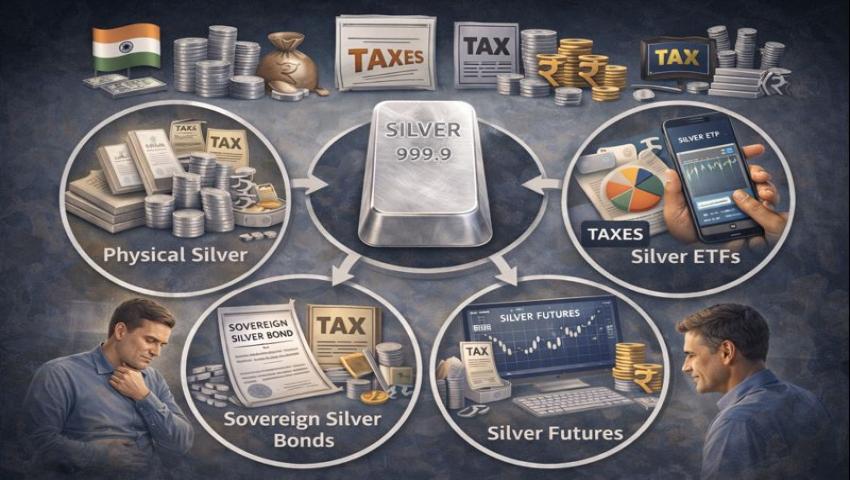

Different Ways to Invest in Silver and Its Taxes: What Every Indian Investor Should Know?

Silver has steadily emerged as a practical and affordable investment option for Indian investors. Apart from its cultural significance and aesthetic appeal, silver is increasingly valued for its industrial use and long-term growth potential.

Section 10(2A) – Exemption on Share of Profit from Partnership Firm or LLP

Section 10(2A) provides that the share of profit received by a partner from a partnership firm or LLP is exempt from income tax in the hands of the partner.

Union Budget 2026 Highlights Simple Guide to Key Tax, Economy & Business Reforms

The Union Budget 2026–27, presented by Finance Minister Nirmala Sitharaman on 1 February 2026, focuses on fast economic growth, better tax compliance, strong infrastructure development, and long-term reforms.

Significance of PAN Card in Income Tax and Business

A PAN card is a ten-character alphanumeric identification number issued by the Income Tax Department of India. It is unique to every PAN holder and remains valid for a lifetime, regardless of changes in address, job, or business structure.

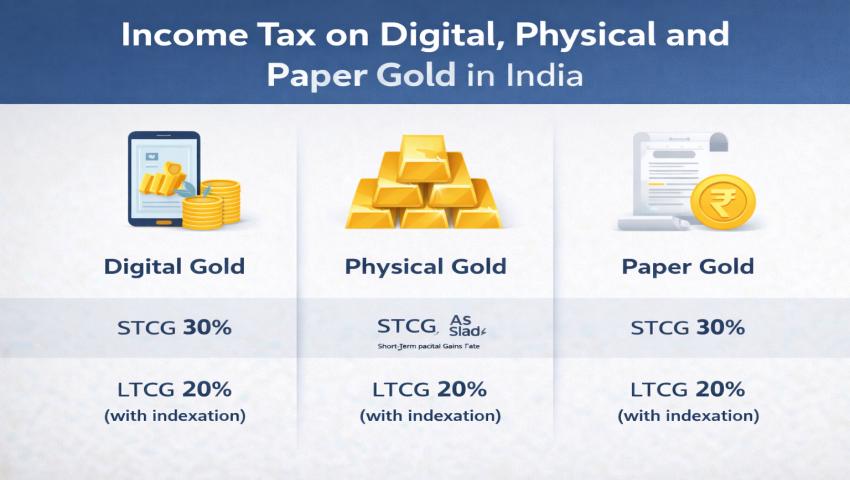

Income Tax on Digital, Physical and Paper Gold in India

Gold has traditionally been one of the most preferred investment avenues in India. Today, investors can choose from multiple formats such as physical gold, digital gold, Gold ETFs, Gold Mutual Funds, Sovereign Gold Bonds, and gold derivatives.

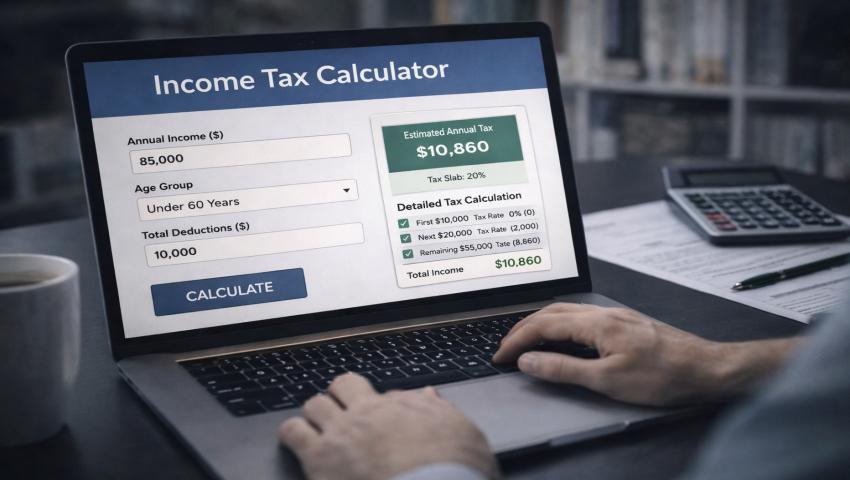

Income Tax Calculator

An Income Tax Calculator is an online tool that enables taxpayers to estimate their income tax liability for a specific financial year.