- 10/02/2026

- MyFinanceGyan

- 32 Views

- 3 Likes

- Tax

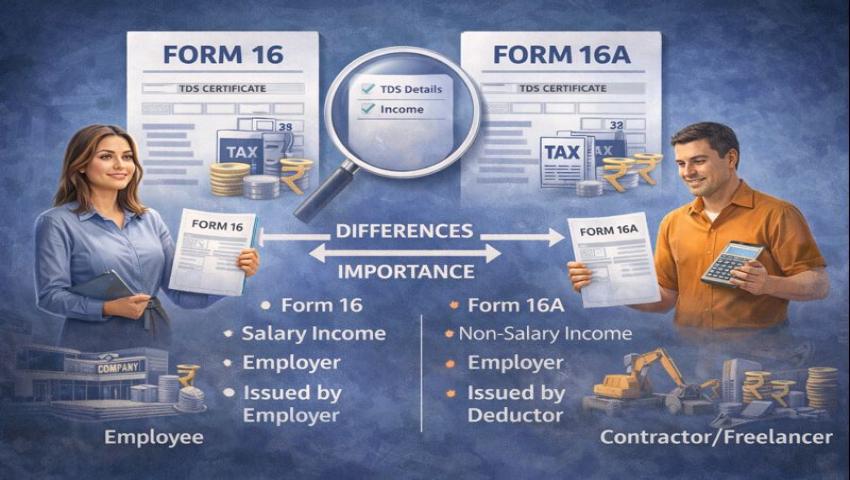

Form 16 and Form 16A – Meaning, Difference and Importance

When it comes to income tax compliance in India, documents related to Tax Deducted at Source (TDS) play a critical role. Among these, Form 16 and Form 16A are the most commonly used TDS certificates. Although both relate to tax deduction, their purpose, applicability, and usage differ—often leading to confusion among taxpayers.

Understanding Form 16 and Form 16A is essential not only for accurate income tax return (ITR) filing but also for ensuring that the correct amount of tax has been deducted and deposited with the Income Tax Department. This article explains the meaning, differences, and importance of Form 16 and Form 16A in a simple and practical manner.

What Is Form 16?

Form 16 is a TDS certificate issued by an employer to a salaried employee. It serves as proof that tax has been deducted from the employee’s salary under Section 192 of the Income Tax Act and deposited with the government.

If you are a salaried individual and TDS has been deducted from your salary during a financial year, your employer is legally required to issue Form 16.

Components of Form 16:

Form 16 consists of two parts:

Part A:

- Employer and employee details (PAN, TAN, name, address)

- Period of employment

- Summary of TDS deducted and deposited

- Challan and receipt details

Part B:

- Detailed breakup of salary

- Exemptions under Section 10 (HRA, LTA, etc.)

- Deductions under Chapter VI-A (such as Sections 80C, 80D)

- Taxable income

- Final tax calculation

Together, Part A and Part B provide a complete snapshot of salary income and tax liability for the financial year.

What Is Form 16A?

Form 16A is a TDS certificate issued for income other than salary. It is provided by the deductor (payer) to the deductee (recipient) when tax is deducted on non-salary payments.

Income Covered Under Form 16A:

Form 16A is issued for TDS deducted on:

- Professional or consultancy fees

- Rent payments

- Interest on fixed deposits and securities

- Commission or brokerage

- Contract payments

Unlike Form 16, Form 16A is issued quarterly and reflects tax deducted during each quarter.

Difference Between Form 16 and Form 16A:

In simple terms, Form 16 applies to salary income, while Form 16A applies to income other than salary.

Importance of Form 16 and Form 16A:

Form 16 and Form 16A are crucial for accurate tax compliance and financial planning.

1. Essential for Filing Income Tax Returns:

These forms provide verified details of income earned and tax deducted at source. They help taxpayers:

- Calculate total taxable income correctly

- Avoid under-reporting or over-reporting income

- Claim accurate TDS credit

Using these certificates ensures that the information in your ITR matches the data available with the Income Tax Department.

2. Proof of Tax Deduction:

Both forms serve as official proof that TDS has been deducted and deposited on your behalf. This is especially important during:

- Income tax scrutiny or notices

- Verification of tax credits

- Dispute resolution

3. Helps in Claiming Refunds:

If excess TDS has been deducted, Form 16 and Form 16A help identify the surplus amount and enable taxpayers to claim refunds while filing their returns.

4. Useful for Financial and Loan Documentation:

Banks and financial institutions commonly ask for Form 16 while processing:

- Home loans

- Personal loans

- Credit card applications

For freelancers and professionals, Form 16A serves as evidence of regular income.

5. Cross-Verification with Form 26AS and AIS:

These forms can be cross-checked with Form 26AS and the Annual Information Statement (AIS) to ensure that all TDS entries are accurately reflected. This reduces the risk of mismatches, delays, and tax notices.

When Are Form 16 and Form 16A Issued?

- Form 16 must be issued by the employer on or before 15 June following the end of the financial year.

- Form 16A is issued quarterly, usually within 15 days from the due date of filing the TDS return.

Failure to issue these certificates on time may attract penalties for the deductor.

What If You Do Not Receive Form 16 or Form 16A?

If you have not received your TDS certificates:

- Contact your employer or deductor immediately

- Verify TDS entries in Form 26AS

- Request correction filings if discrepancies are found

Although you can file your return using salary slips and bank statements, having Form 16 and Form 16A significantly reduces errors and simplifies the filing process.

Common Mistakes to Avoid:

- Treating Form 16 and Form 16A as interchangeable

- Filing returns without cross-checking TDS details

- Ignoring mismatches between Form 16/16A and Form 26AS or AIS

- Missing income reported in Form 16A, especially for freelancers and professionals

Avoiding these mistakes ensures smooth and compliant tax filing.

Conclusion:

Form 16 and Form 16A are essential documents for every taxpayer in India. While Form 16 relates to salary income, Form 16A applies to non-salary income. A clear understanding of their meaning, differences, and importance helps individuals file accurate income tax returns, claim refunds efficiently, and remain compliant with tax laws.

Whether you are a salaried employee, freelancer, professional, or investor, keeping track of these TDS certificates is key to effective financial planning and stress-free tax compliance.

Disclaimer: This article is for general informational purposes only and does not constitute legal, tax, or professional advice; readers are advised to consult a qualified tax professional for guidance specific to their situation.