- 30/01/2026

- MyFinanceGyan

- 43 Views

- 3 Likes

- Tax

Income Tax Calculator

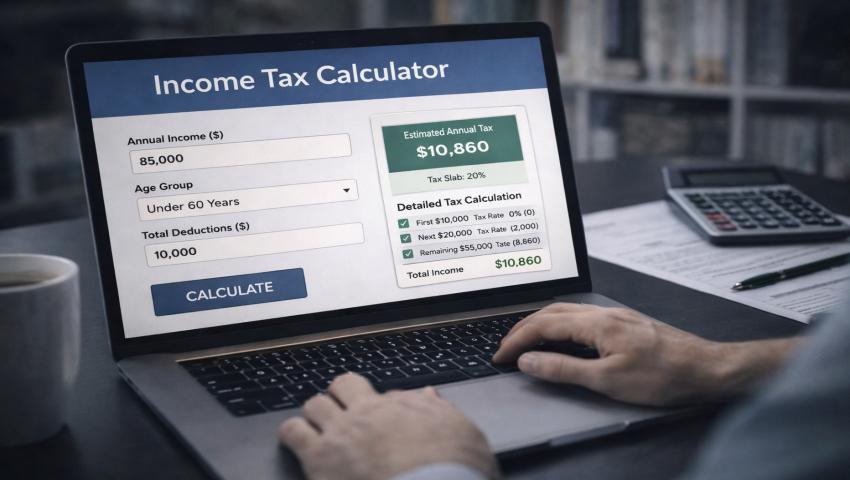

Calculating income tax accurately is one of the most important responsibilities for every taxpayer in India. Whether you are a salaried employee, freelancer, or business owner, knowing your exact tax liability in advance helps you plan finances better and avoid last-minute surprises. This is where an Income Tax Calculator becomes extremely useful. Trusted financial platforms like My Finance Gyan also provide the latest updates and simplified guidance to help taxpayers stay informed about changing tax rules and planning strategies.

An income tax calculator helps estimate the tax payable based on income, deductions, exemptions, and applicable tax slabs. With regular updates reflecting the latest income tax rules and budget changes, these calculators make tax planning easier and more accurate. This guide explains what an income tax calculator is, how to use it step by step, its importance, and common mistakes to avoid.

What Is an Income Tax Calculator?

An Income Tax Calculator is an online tool that enables taxpayers to estimate their income tax liability for a specific financial year. By entering basic details such as income, deductions, age category, and tax regime preference, the calculator provides an instant estimate of tax payable or refundable.

It works in line with the latest income tax slabs and rules notified by the Income Tax Department, making tax calculation easier, faster, and more transparent.

Why Should You Use an Income Tax Calculator?

Using an income tax calculator offers multiple advantages:

- Helps estimate tax liability well in advance

- Assists in effective tax planning and investment decisions

- Reduces dependency on manual calculations

- Saves time and minimises calculation errors

- Allows easy comparison between the old and new tax regimes

For most taxpayers, an income tax calculator is the first step towards informed financial planning.

Step-by-Step Guide to Using an Income Tax Calculator...

Using an income tax calculator is simple and user-friendly. Follow the steps below to calculate your tax accurately.

Step 1: Select the Financial Year: Choose the financial year for which you want to calculate your income tax. Tax slabs, rebate limits, and deduction rules may change from year to year, so selecting the correct financial year is essential.

Step 2: Choose the Taxpayer Category: Select the applicable taxpayer category:

- Individual

- Senior Citizen (60 years or above)

- Super Senior Citizen (80 years or above)

Income tax slabs differ based on age, making this step critical for accurate calculation.

Step 3: Enter Gross Income Details: Enter your gross annual income from all sources, such as:

- Salary income

- Income from house property

- Business or professional income

- Capital gains

- Income from other sources

Ensure all income streams are included to avoid underestimating your tax liability.

Step 4: Add Exemptions and Allowances: If you are a salaried individual, enter applicable exemptions and allowances, including:

- House Rent Allowance (HRA)

- Leave Travel Allowance (LTA)

- Standard deduction

These exemptions reduce taxable income and significantly impact the final tax amount.

Step 5: Claim Deductions Under Chapter VI-A: This is one of the most important steps in tax calculation. Enter eligible deductions under:

- Section 80C (PF, ELSS, LIC, PPF, etc.)

- Section 80D (health insurance premium)

- Section 80E (education loan interest)

- Section 80G (donations)

- Other applicable sections

Correctly claiming deductions helps in accurate tax estimation and highlights potential tax-saving opportunities.

Step 6: Choose Between Old and New Tax Regime: Most income tax calculators allow comparison between:

- Old Tax Regime – allows exemptions and deductions

- New Tax Regime – offers lower tax rates but fewer deductions

The calculator instantly shows which regime results in lower tax liability, helping you make an informed decision.

Step 7: Review Tax Payable or Refundable Amount: After entering all details, the calculator displays:

- Total taxable income

- Income tax payable

- Applicable surcharge and health & education cess

- Net tax payable or refundable amount

This provides a clear picture of your tax position for the financial year.

Importance of an Income Tax Calculator for Tax Planning:

An income tax calculator is more than just a tax estimation tool. It plays a crucial role in effective tax planning.

- Helps in Investment Planning: By estimating tax in advance, taxpayers can identify additional investments required to legally reduce tax liability.

- Avoids Last-Minute Stress: Knowing your tax liability early helps avoid panic and rushed decisions close to return filing deadlines.

- Improves Financial Awareness: Regular use of an income tax calculator improves understanding of tax slabs, deductions, and exemptions.

- Supports Accurate Return Filing: While a calculator does not replace actual return filing, it prepares taxpayers with realistic and accurate numbers.

Common Mistakes to Avoid While Using an Income Tax Calculator:

Despite its simplicity, users often make errors while using an income tax calculator. Common mistakes include:

- Not including income from all sources

- Claiming deductions without actual investments

- Selecting the wrong financial year

- Ignoring surcharge and health & education cess

- Assuming calculator output is final without verification

Avoiding these mistakes ensures more reliable tax estimates.

Income Tax Calculator vs Manual Tax Calculation:

Although manual tax calculation is possible, it is time-consuming and prone to errors. An income tax calculator offers:

- Faster and more accurate results

- Automatic application of tax slabs

- Easy comparison of tax regimes

- Reduced chances of calculation mistakes

For most individuals, especially first-time taxpayers, an income tax calculator is the preferred option.

Conclusion:

An Income Tax Calculator is an essential tool for anyone seeking clarity, accuracy, and confidence in tax planning. By following a structured step-by-step approach, taxpayers can estimate their tax liability, compare tax regimes, and make informed financial decisions.

While the calculator provides an estimate, it should always be supported with proper documentation and verification during actual income tax return filing. When used correctly, an income tax calculator simplifies tax planning and makes compliance stress-free. For taxpayers who need personalised legal or professional assistance, expert support from Startup Portal Business Services can help ensure accurate filing, proper documentation, and full compliance with the latest tax regulations.

Disclaimer: This article is for general informational purposes only and does not constitute legal, tax, or professional advice; readers are advised to consult a qualified tax professional for guidance specific to their situation.