Investing in India: Why It’s Important & Where to Invest?

Investing means putting your money into assets that can grow over time, helping you build wealth for the future.

Income Tax for NRIs: A Simple Guide

Taxes are the foundation of India's economy, and the rules for Non-Resident Indians (NRIs) are different from those for resident Indians.

How to Legally Protect Your Startup Idea? NDA, Trademark, Copyright Demystified

At My Finance Gyan, we think that a great idea is the seed of all successful startups.

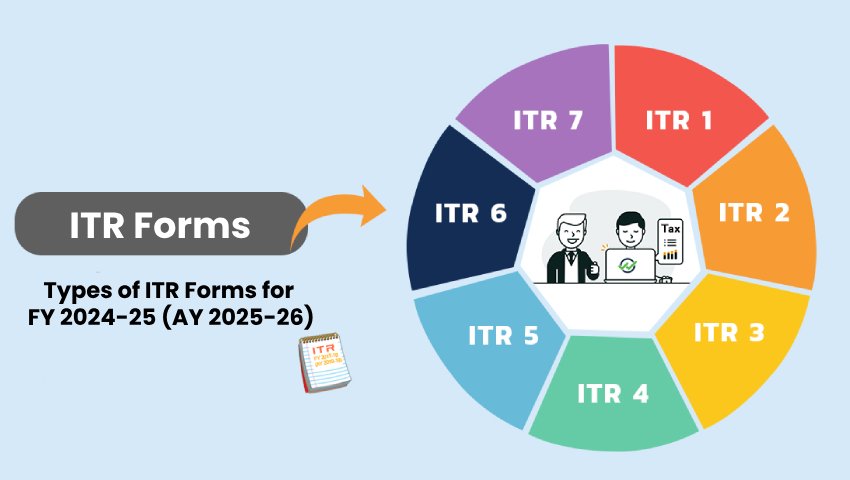

Which ITR Should I File? Types of ITR Forms for FY 2024-25 (AY 2025-26)

Income Tax Return (ITR) is the form taxpayers use to report their income, claim deductions, and pay tax to the Income Tax Department of India.

Types of Taxes in India: Direct and Indirect Taxes Explained

Taxes are mandatory contributions imposed by the Central and State Governments on individuals and businesses.

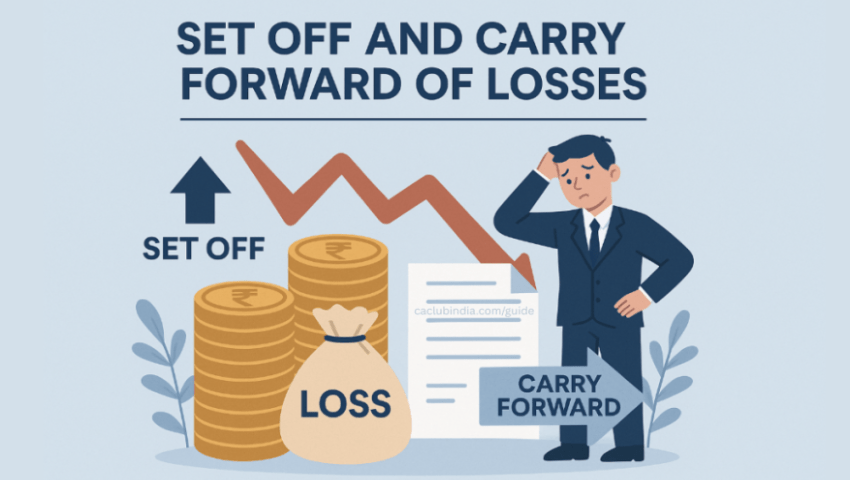

Set-Off and Carry Forward of Losses: A Guide for FY 2024–25

Profits and losses are inevitable parts of running a business.

NAV (Net Asset Value) in Mutual Funds: Meaning, Formula & How It Is Calculated?

When choosing a mutual fund, many investors focus on past returns while overlooking one important factor — NAV, or Net Asset Value.

What Are NABARD Notified Bonds and How Do They Work?

For investors seeking a stable and low-risk investment option amidst stock market volatility, NABARD Notified Bonds offer a secure alternative.

What Are Zero Coupon Bonds and Who Should Invest in Them?

Bonds are essential tools in the world of fixed-income investing.

What Are Asset Allocation Funds?

Asset Allocation Funds are mutual fund schemes that invest in a mix of different asset classes, such as equities, debt instruments, gold, commodities, or even real estate.