Appointment of Additional Director: Process, Legal Provisions, and Practical Guide

An Additional Director is a director appointed by the Board of Directors between two Annual General Meetings. This appointment is temporary in nature and is made to address immediate business or governance needs.

What Is Commercial Tax? Meaning, Types & Examples

In simple words, Commercial Tax is a tax imposed by the State Government on commercial activities. It is an indirect tax, meaning the business pays it to the government, but the cost is ultimately recovered from the customer.

About GST – How to get a GST number?

A gst number is a 15-digit alphanumeric code assigned to every registered business. Think of it as your business's unique identity card for all tax-related matters.

100+ Profitable Small Business Ideas in India for 2026

India is witnessing a massive surge in entrepreneurship. With digital tools becoming more accessible and the government supporting new startups, 2026 is the perfect year to launch your own venture.

Entrepreneurship and Entrepreneur: Meaning, Importance, and Role in Finance

To define the term entrepreneur, we must look at the person behind the idea. In simple words, an entrepreneur is an individual who identifies a need in the market and starts a new business to fill that gap.

GST on Gold: What You Need to Know?

Before GST was introduced in 2017, gold was subject to a variety of taxes like Value Added Tax (VAT) and Excise Duty, which varied from state to state.

How to Do Online Income Tax Return (ITR) Filing in India?

An Income Tax Return (ITR) is a form used to declare your annual income, tax-saving deductions, and taxes paid to the Income Tax Department. Filing ITR is a sign of financial discipline and is mandatory for those whose income exceeds the basic exemption limit.

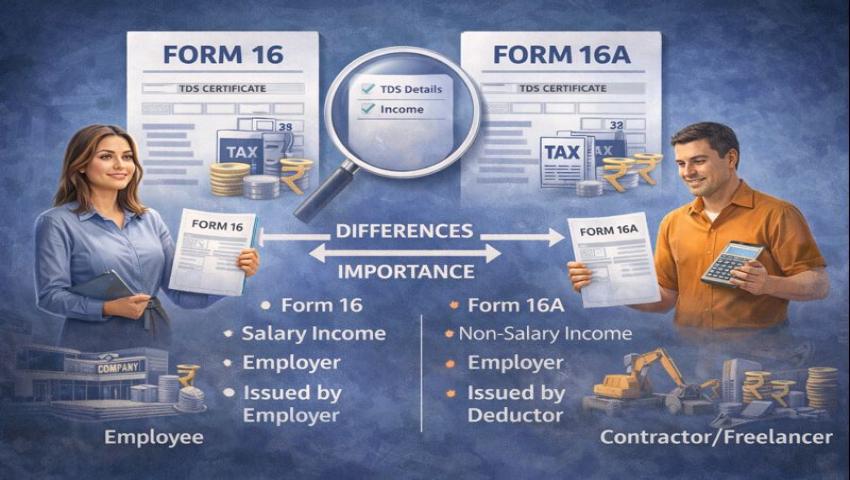

Form 16 and Form 16A – Meaning, Difference and Importance

When it comes to income tax compliance in India, documents related to Tax Deducted at Source (TDS) play a critical role. Among these, Form 16 and Form 16A are the most commonly used TDS certificates.

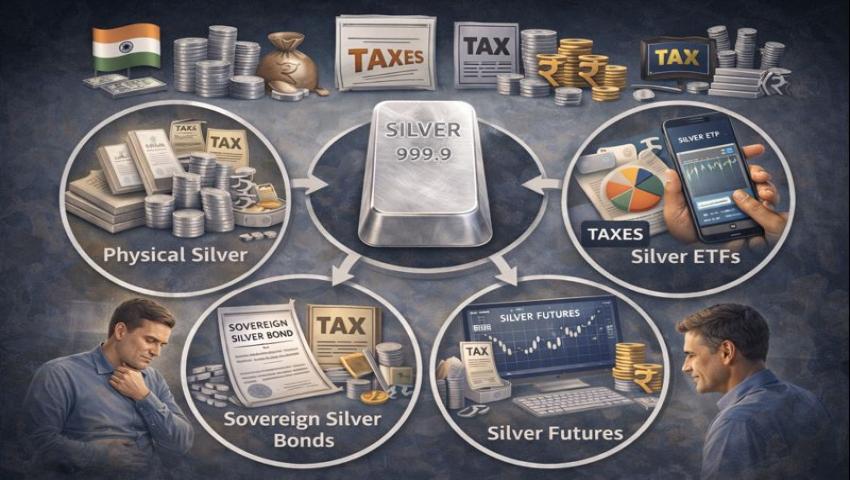

Different Ways to Invest in Silver and Its Taxes: What Every Indian Investor Should Know?

Silver has steadily emerged as a practical and affordable investment option for Indian investors. Apart from its cultural significance and aesthetic appeal, silver is increasingly valued for its industrial use and long-term growth potential.

Models of GST – Types Explained Simply

The introduction of Goods and Services Tax (GST) marked one of the most significant reforms in India's indirect tax system. By replacing multiple indirect taxes with a unified framework, GST brought transparency and consistency across the country.