The Role of SIPs, Index Funds, and Defensive Sectors in Managing Volatility and Building Long-Term Wealth

Successful wealth creation is less about predicting market movements and more about adopting strategies that reduce emotional decisions and allow compounding to work over decades.

What Quarterly GDP Numbers Mean for Stock Markets, Interest Rates, and Your Portfolio?

Economic growth is the lifeblood of any economy, and Gross Domestic Product (GDP) is its most widely tracked measure. Every quarter, GDP data releases command the attention of investors, economists, policymakers, and financial markets across the world.

The Impact of AI, Trade Wars, and Geopolitical Instability on Global Markets and Asset Allocation

Artificial intelligence, rising trade tensions, and ongoing geopolitical instability are profoundly reshaping global financial markets.

Real vs Nominal GDP: Why Investors Should Always Think in Inflation-Adjusted Terms?

Yet there is an uncomfortable truth behind these numbers: headline GDP often misleads investors. Not because it is wrong, but because most attention falls on nominal GDP, not real GDP.

Is GDP an Outdated Metric?

For decades, Gross Domestic Product (GDP) has been the headline indicator of a nation's economic success. Rising GDP figures are often celebrated as proof of progress, prosperity, and stability.

What Rising GDP and Sticky Inflation? Mean for Equity, Debt, and Gold Investors

Two macroeconomic indicators are dominating global economic conversations today: rising GDP (Gross Domestic Product) and sticky inflation. For investors across asset classes—equities, debt, and gold—understanding how these forces interact is essential for making sound investment decisions.

How Labor Market Shifts and Carbon Taxes Are Reshaping Investment Decisions and Economic Resilience

These trends do more than affect short-term profitability. They redefine long-term competitiveness, alter risk perceptions, and reshape the foundations of economic stability.

Emerging Opportunities in Renewable Energy, Infrastructure, and Global Equities

They represent how economies will grow in the coming decades. Understanding these sectors can help investors, businesses, and individuals make better long-term decisions.

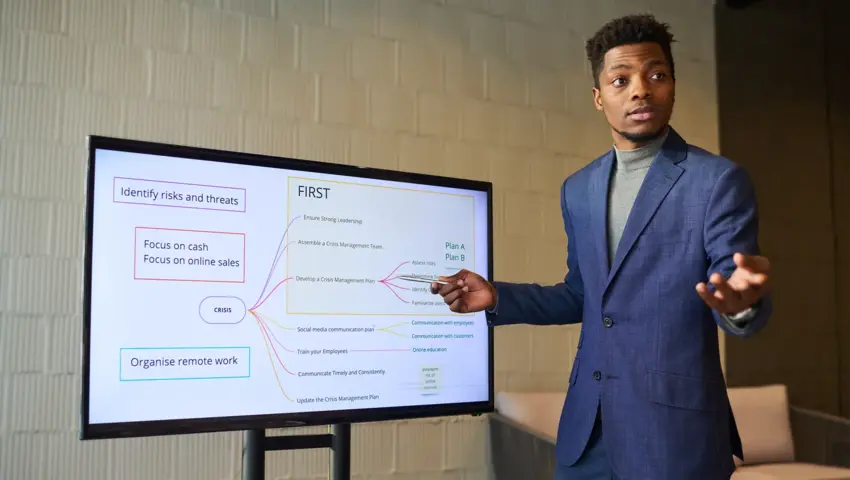

How to Prepare a Pitch Deck That Attracts Investors: A Complete Guide for Founders

In today’s fast-moving startup world, capturing an investor’s attention is one of the biggest challenges founders face. With thousands of entrepreneurs pitching daily, your pitch deck becomes your gateway to standing out. More than just a presentation, it is the story of your vision—showcasing your idea, the market opportunity, your […]

Angel Investors in India: Who They Are & How to Approach Them

Angel investors are high-net-worth individuals who invest their personal money into early-stage startups in exchange for equity.