ITR-3 Form: Complete Guide for AY 2025-26 (FY 2024-25)

Filing your income tax return with the correct ITR form is crucial for accurate compliance.

ITR-2 Form: Complete Guide for FY 2024-25 (AY 2025-26)

When it comes to income tax filing, choosing the correct form is essential.

ITR-1 (Sahaj) Form for FY 2024-25 (AY 2025-26)

In India, taxpayers must file income tax returns based on their income category.

GST Return Filing Deadline Alert: 3-Year Limit Now Enforced from July 2025

India's GST regime is changing, and the impact is irreversible this time.

TDS Compliance for Startups: When, How, and What to File?

Starting a startup is thrilling, but staying compliant with Indian tax laws is non-negotiable.

How AI is Revolutionising Compliance and Filing for Indian Startups

Compliance is a big deal for startups in India. Whether it's GST, Income Tax, or ROC filings – missing deadlines or making errors can lead to heavy penalties.

Investing in India: Why It’s Important & Where to Invest?

Investing means putting your money into assets that can grow over time, helping you build wealth for the future.

Income Tax for NRIs: A Simple Guide

Taxes are the foundation of India's economy, and the rules for Non-Resident Indians (NRIs) are different from those for resident Indians.

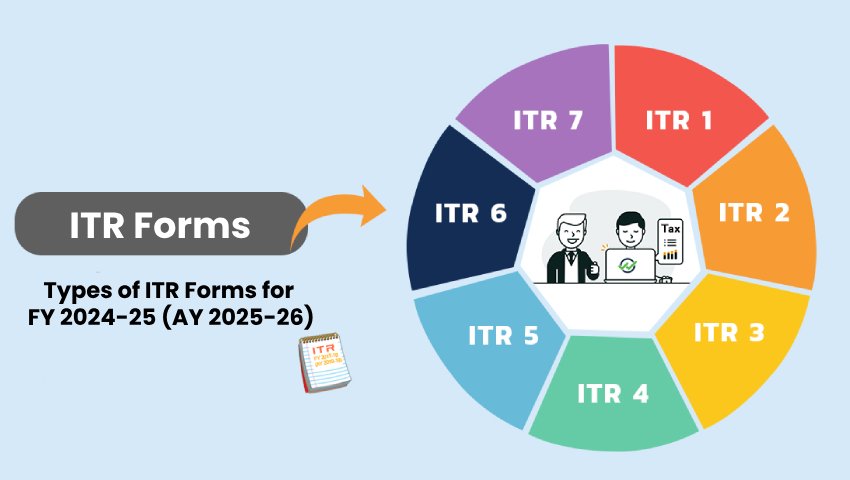

Which ITR Should I File? Types of ITR Forms for FY 2024-25 (AY 2025-26)

Income Tax Return (ITR) is the form taxpayers use to report their income, claim deductions, and pay tax to the Income Tax Department of India.

Types of Taxes in India: Direct and Indirect Taxes Explained

Taxes are mandatory contributions imposed by the Central and State Governments on individuals and businesses.