- 31/05/2025

- MyFinanceGyan

- 854 Views

- 4 Likes

- Tax

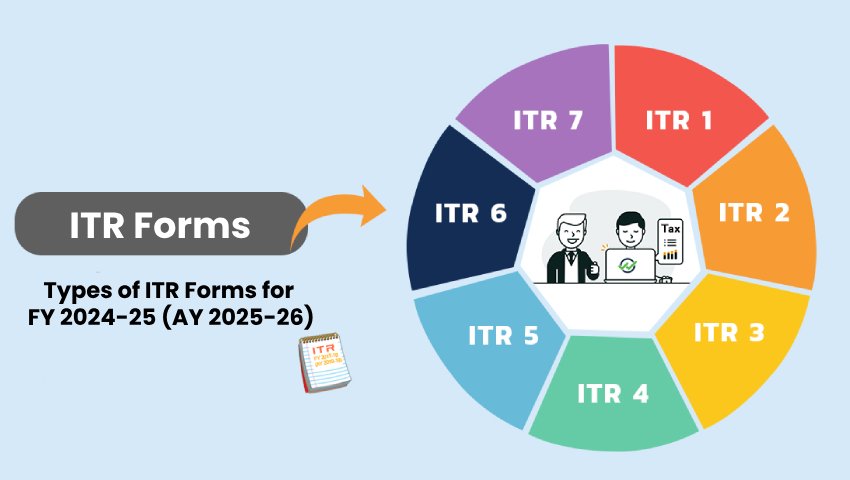

Which ITR Should I File? Types of ITR Forms for FY 2024-25 (AY 2025-26)

Income Tax Return (ITR) is the form taxpayers use to report their income, claim deductions, and pay tax to the Income Tax Department of India. For Financial Year (FY) 2024–25 (Assessment Year 2025–26), the Central Board of Direct Taxes (CBDT) has notified seven types of ITR forms, applicable based on the taxpayer’s income source, income amount, and category (individual, HUF, firm, etc.).

Let’s understand what ITR is, who should file it, and which ITR form is right for you.

What is ITR?

Income Tax Return (ITR) is a document used to declare your income, deductions, and taxes paid (if any) to the Income Tax Department. Filing your ITR helps you:

- Claim a tax refund (if eligible)

- Serve as proof of income for loans and visas

- Carry forward losses (if applicable)

- Comply with Indian tax laws

Types of ITR Forms for FY 2024-25 (AY 2025-26):

ITR-1 (SAHAJ) – For Salaried Individuals:

Applicable to:

Resident individuals with total income up to ₹50 lakh from:

- Salary or pension

- One house property (not carrying forward losses)

- Other sources (excluding lottery/racehorses)

- Long-term capital gains up to ₹1.25 lakh (no carry-forward)

- Agricultural income up to ₹5,000

Not Applicable If:

- Income exceeds ₹50 lakh

- Income from multiple house properties

- Capital gains (except allowed exemption)

- Business or profession income

- Director in a company

- Foreign income/assets

- RNOR or non-resident

- ESOP tax deferred

- Carry forward of losses

ITR-2 – For Individuals & HUFs (No Business Income):

Applicable to:

Individuals/HUFs with:

- Salary/Pension

- Income from multiple house properties

- Capital gains

- Foreign income or assets

- Agricultural income above ₹5,000

- Winnings from lottery or horse races

- Investment in unlisted equity shares

- Director in a company

Not Applicable If:

- Income from business or profession (use ITR-3/4 instead)

ITR-3 – For Individuals/HUFs with Business or Profession:

Applicable to:

Individuals or HUFs earning income from:

- Proprietary business or profession

- Partnership firm income (not the firm itself)

- Investment in unlisted equity shares

- Capital gains, salary, house property, other sources

Use this if you are not eligible for ITR-1, ITR-2, or ITR-4.

ITR-4 (Sugam) – For Presumptive Income (Section 44AD, 44ADA, 44AE):

Applicable to:

Resident Individuals, HUFs, and Firms (excluding LLPs) with:

- Total income up to ₹50 lakh

- Income from business/profession under presumptive scheme

- One house property (not carrying forward losses)

- Salary or pension

- Other sources (except lottery/racehorses)

- Long-term capital gains up to ₹1.25 lakh (no carry-forward)

Not Applicable If:

- Income exceeds ₹50 lakh

- More than one house property

- Foreign assets or income

- Director in a company

- Investment in unlisted shares

- RNOR or non-resident

- Carry forward of losses

- ESOP tax deferred

ITR-5 – For Firms, LLPs, AOPs, BOIs, and Others:

Applicable to:

- Partnership firms

- LLPs

- AOPs, BOIs

- Estate of deceased/insolvent

- Business trusts, investment funds

- (Not applicable for individual taxpayers)

ITR-6 – For Companies (Other than Charitable/ Religious):

Applicable to:

All companies except those claiming exemption under Section 11 (i.e. charitable/religious trusts). Filing must be done electronically only.

ITR-7 – For Trusts, Political Parties, Educational Institutions, etc.

Applicable under Sections:

- 139(4A): Charitable/religious trusts

- 139(4B): Political parties

- 139(4C): Scientific institutions, news agencies

- 139(4D): Universities, colleges

- 139(4E): Business trusts

- 139(4F): Investment funds under Section 115UB

Comparison Table: ITR Forms at a Glance:

Why Should You File ITR?

Even if you’re not mandated to file, here’s why it’s still a good idea:

- To claim tax refunds

- Required when applying for visas or loans

- To carry forward losses

- If you have foreign income/assets

- If you are a company/firm, ITR filing is mandatory, even with zero income

When Is Filing ITR Mandatory?

When your Gross Total Income (GTI) exceeds the basic exemption limit:

Old Regime Exemption Limits:

New Regime (all ages): ₹3 Lakh:

You must also file ITR if:

- You deposited over ₹1 crore in a bank account

- Spent over ₹2 lakh on foreign travel

- Spent over ₹1 lakh on electricity bills

- You are claiming foreign tax relief, ESOP tax deferral, or have losses to carry forward

Need Help Choosing the Right ITR Form?

If you’re still confused about which ITR form to file, consult a Chartered Accountant or a tax expert. Filing the wrong form can result in notice from the IT department or rejection of your ITR.

File Your ITR Before the Due Date!

For FY 2024–25, the due date for filing ITR (without audit) is 31st July 2025. Don’t wait till the last minute—start early and avoid penalties.

Ready to File?

Whether you’re a salaried employee, freelancer, business owner, or investor, make sure to choose the right ITR form based on your income profile. Filing correctly and on time ensures a smooth tax season and peace of mind.