Significance of PAN Card in Income Tax and Business

A PAN card is a ten-character alphanumeric identification number issued by the Income Tax Department of India. It is unique to every PAN holder and remains valid for a lifetime, regardless of changes in address, job, or business structure.

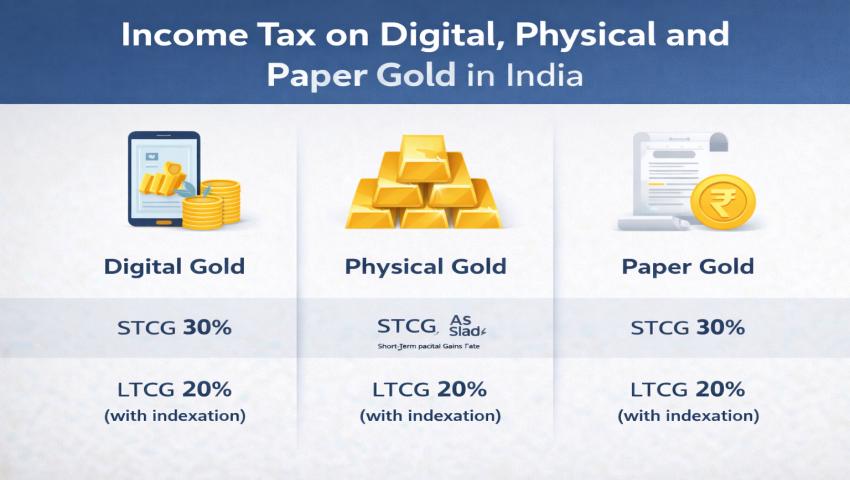

Income Tax on Digital, Physical and Paper Gold in India

Gold has traditionally been one of the most preferred investment avenues in India. Today, investors can choose from multiple formats such as physical gold, digital gold, Gold ETFs, Gold Mutual Funds, Sovereign Gold Bonds, and gold derivatives.

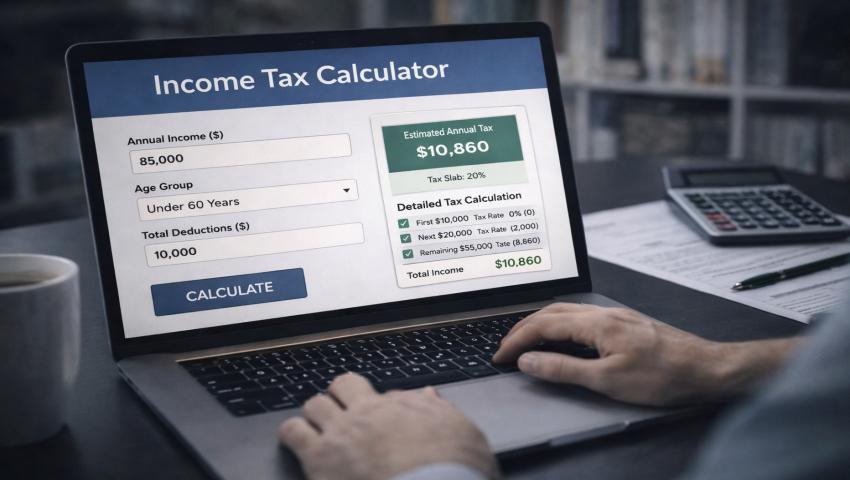

Income Tax Calculator

An Income Tax Calculator is an online tool that enables taxpayers to estimate their income tax liability for a specific financial year.

What is Roc filing? How Can ROC Filing Be Done Easily and Accurately?

The ROC full form in company law is the Registrar of Companies. This is the official authority appointed under the Companies Act to oversee the registration and regulation of companies in India.

What Is GST Tax Exemption? Meaning, Rules, and Eligibility Explained

Navigating the complex landscape of the Goods and Services Tax (GST) in India can be a daunting task for entrepreneurs and small business owners. However, understanding goods and services tax exemptions is a game-changer for your financial planning.

Status of ITR: How to Check Your Income Tax Refund Status in India?

An income tax refund arises when the tax you have paid (through TDS, Advance Tax, or Self-Assessment Tax) exceeds your actual tax liability calculated for the year. Essentially, it is your own hard-earned money being returned to you by the government.

Conversion of Section 8 Company to Private Limited: Step-by-Step Process

A Section 8 company is primarily formed for charitable or social objectives, where profits are reinvested into the cause rather than distributed to members. However, as organizations grow, they often face limitations in raising equity capital or distributing dividends.

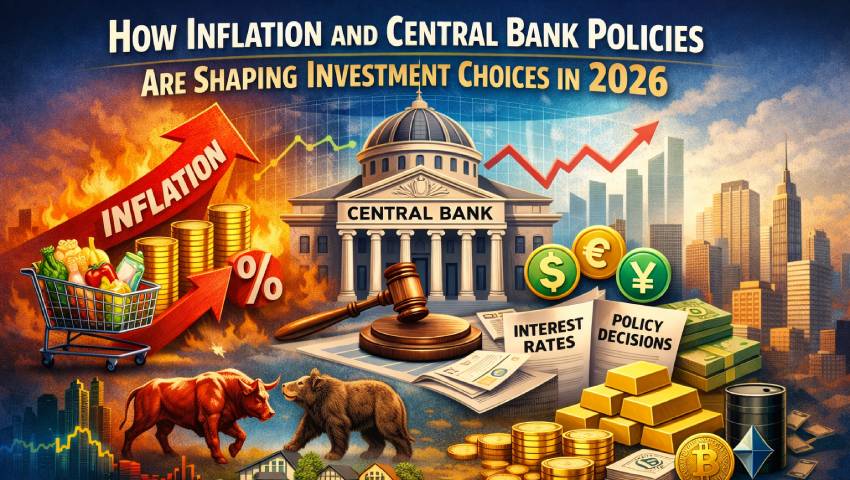

How Inflation and Central Bank Policies Are Shaping Investment Choices in 2026?

Inflation across many advanced economies has cooled significantly from the post-pandemic highs, but it has not fully returned to the ultra-low levels seen before 2020.

How Central Banks and Governments Use GDP Data to Make Major Policy Decisions

Central banks and governments rely heavily on GDP data to frame critical monetary and fiscal policies. Whether it is setting interest rates, planning public spending, or adjusting taxes, GDP trends help policymakers decide how to steer the economy toward stability and sustainable growth.

How to Strike Off Company in India: Step-by-Step Procedure & Documents

The term strike off refers to the removal of a company's name from the official Register of Companies maintained by the Registrar of Companies (ROC).